This year we celebrate 21 years of delivering insights into the housing market through the Australian Housing Outlook report.

Authored by BIS Oxford Economics, the Green Edition explores how the housing market is changing as we move towards a sustainable future. Australia has made many gains in the way we approach more efficient and effective green living standards. The report incorporates a comprehensive view of housing, sustainability and the housing outlook as Australia and dwelling prices enters a phase of correction.

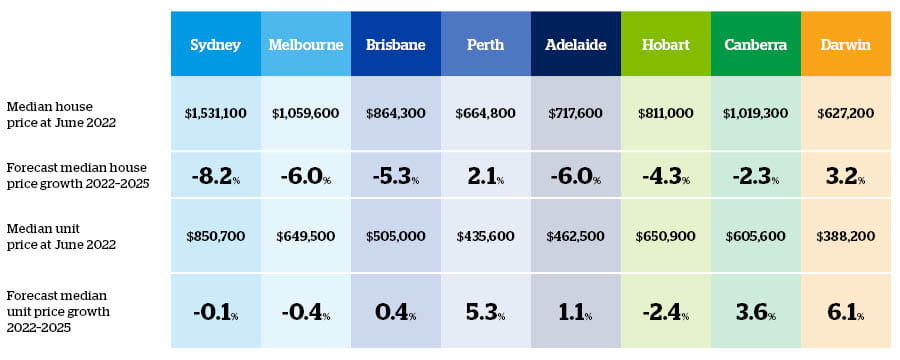

Capital cities at a glance

Housing market insight

The housing market slowdown will be widespread but with significant variation across geographies. Sydney is the most indebted and least affordable capital city, making it the most susceptible to rising borrowing costs and is therefore expected to experience the most substantial decline. Perth on the other hand is finding support from a buoyant resources sector and a strong recovery in population flows.

QBE LMI launches 5% benefit for green home buyers

QBE LMI has launched a new 5 per cent rate reduction for LMI through its participating exclusive partners, designed to encourage and increase affordability of green home ownership*.

This first-to-market benefit is available to LMI customers purchasing or refinancing new or existing homes, or seeking construction loans, with a green mortgage through National Australia Bank (NAB) or Bank Australia.

Finder Green Awards: Green Insurer of the Year

For the fourth year running QBE has been named by finder.com.au as Australia’s Green Insurer of the Year. This award recognises QBE's focus on reducing its environmental footprint, commitment to sourcing electricity from renewable sources for its global operations and its emissions reduction targets.

We're honoured to receive this recognition. A big thank you to our customers, people and partners for helping us enable a more resilient planet.

* QBE LMI provides a rate discount to its participating exclusive partners for green home loans which meet their and QBE LMI’s green mortgage eligibility criteria and where the LVR is greater than 80%. Subject to QBE LMI approval and minimum LMI premium.

The information on this page is of a general nature and observations about the property market and its trends are not intended to be construed as financial advice. For property market financial advice, speak with a professional.