Storm recovery: what to do after a storm

This article was originally published in March 2017 and was updated in October 2021.

- It’s natural to be anxious about what to do after a storm, but some simple steps can help restore life to normal

- Be careful when checking for damage to your home especially around loose ceilings, which may contain asbestos

- Take photos of any damage, and lodge an insurance claim as soon as you safely can to start the ball rolling with the repair process.

Storms cost Australia around $2.3 billion annually, so it’s natural to be worried about how your home, property and community have all fared following a storm.

Concerns over possible damage can make knowing what to do after a storm overwhelming. However, following a few steps can help you assess the damage and start to restore your property while staying safe.

Consider storm safety first

Check the storm is over and it’s safe to go outside by heading to the Bureau of Meteorology website to check storm warnings. Use any weather apps you may have or listen to bulletins from your local radio station.

Related article: How to prepare for a severe storm

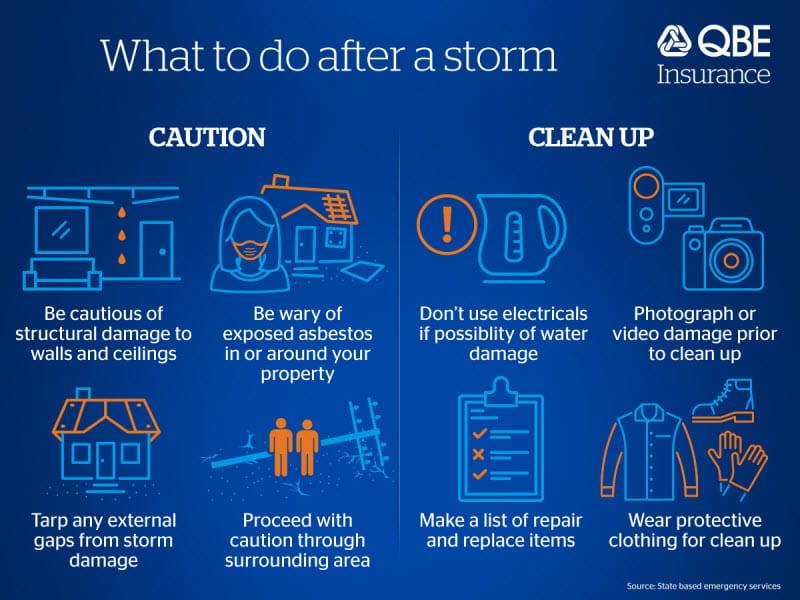

Check inside your home for damage

The first step is to check the interior of your home. Heavy downpours can pose a threat to home wiring, so check that electrical items have not been affected by water and are safe to use. If you’re not sure, it’s best to play it safe and either dispose of the appliances or have them tested by a licensed electrician before you use them, particularly if there were a lot of lightning strikes in your area.

Check for water seeping into your home. Stormwater runoff can damage carpets and flooring. Heavy downpours can also leave ceilings susceptible to storm damage particularly if gutters have become clogged or roof tiles have blown off. Warning signs to look for include sagging or dropping cornices or plasterboard sheeting, cracking and/or small circles or blisters (nail pops) on the ceiling. If carpet has been destroyed it can be appropriate to remove and discard it, however it’s a good idea to hold onto a sample.

Hail can cause considerable physical damage, so check for cracked or broken glass in doors, windows and skylights.

Damage outside your home

Your roof calls for careful examination, but only if it’s safe to do so. For serious problems like fallen trees, contact your state-based emergency service on 132 500. If high winds have lifted roof sheeting, tarps can be used to keep your home water-proof until repairs can be arranged.

Be aware, if your home was built before 1990, there is a good chance the roof may contain asbestos. If you suspect this could be the case, do not attempt repairs on your own – you will need to arrange expert help.

Check your car

Hailstorms are notorious for damaging cars. If your car has taken a few hailstones, it may still be drivable but it’s best to avoid heading out onto the road if the windscreen is damaged. Contact us to lodge a claim on your QBE Car Insurance to get started with the next steps that are appropriate for your situation.

Watch for flash flooding

Even if your car is intact, resist the urge to check the neighbourhood for storm damage. It’s not just about keeping roads free for emergency services. Flash floods can be a serious threat following storms, and they can happen quickly with little or no warning.

Urban areas can be especially prone to flash floods because drains may be overwhelmed with run-off from heavy rainfall. It’s better to avoid the roads altogether and use the phone to check if neighbours need assistance.

If you were out driving and remained in your car during a storm, you can resume your journey when it’s safe. But take it slowly. Roads can be slippery or covered in debris, and in soggy conditions your vehicle can easily become bogged. Never enter flood waters.

Disaster chaser scams

Unfortunately, severe storms often attract the interest of scammers. Over the years, so-called ‘disaster chaser scams’ have come in various forms including con artists door-knocking storm-damaged suburbs claiming to represent insurers and demanding cash for clean-up and repair services. Scammers may also offer to liaise with your insurer on your behalf – for a fee.

The common thread is that disaster chaser scams aim to exploit vulnerable householders following storms. You should not feel pressured by a disaster chaser to sign a contract, hand over money or allow them to start any repair work on your home.

Remember, insurers will only pay for approved work that is covered by your policy. If you come across a disaster chaser please report them to the relevant authorities.

The claim process after a storm

The destruction caused by storms can be devastating, but the good news is that making a claim on your QBE Home Insurance or QBE Contents Insurance should be simple and stress-free.

Take plenty of photos of any damage in and around your home, and lodge your claim as soon it’s safely possible. If you're a QBE Home Insurance policyholder find out more about lodging a claim.

If you’re unsure whether you’re covered, check your Product Disclosure Statement (PDS) or contact us on 133 723.