Trading Through Uncertainty

Introduction

The ability to continue to trade matters in business, irrespective of what’s going on inside or outside the office, shop or warehouse.

This need for certainty in an uncertain world is felt most acutely by small businesses who must plan their futures without the breadth of support traditionally enjoyed by larger organisations.

Business interruption insurance deals with the continuity of income after insured property is damaged or lost after an unexpected event. It can be a powerful solution to this environment of unknowns. Its ability to deliver continuity of income after an unexpected event is transformative.

Few businesses are immune to the threat of a business interruption.

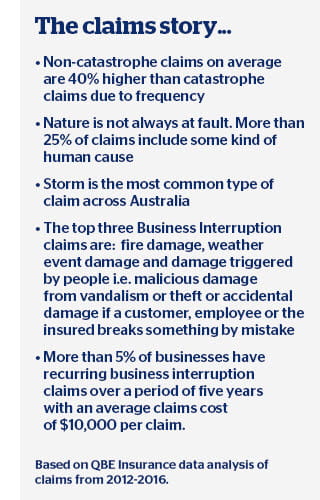

Our own data1 reveals the top three claims stem from fire damage, weather event damage and damage triggered by people.

More than a quarter of claims have some type of human cause. For example, malicious damage from vandalism or theft or accidental damage if a customer, employee or the insured breaks something by mistake.

And yet, recent research commissioned by QBE Insurance2 has revealed just 17% of small businesses currently hold business interruption insurance, a result that’s likely linked to a lack of understanding and knowledge of the cover or appreciation of the financial impact that an interruption to the business can have.

Delving further into existing levels of understanding reveals that 43% of small business owners have never heard of business interruption insurance, while 11% say they know it exists but don’t know anything about it. Just over one in five (23%) say they only have a vague idea of what it covers.

This report investigates this gap in knowledge, while delving deeply into the latest intelligence around business interruption insurance and how it may be relevant to small and medium businesses in Australia.

How can business interruption insurance help small and medium businesses?

A metro retailer’s ability to trade is severely impacted when a water main bursts outside its premises, cutting off access and reducing customer traffic and causing takings to drop for weeks on end while the council attempts to find a fix.

The premises and stock of a regional supermarket is destroyed in a fire started by a just-installed faulty fridge putting the future of a community-critical business at risk.

A small family business can’t trade as usual when a critical piece of machinery is damaged by fire. There’s no more money coming in, but the business must find a way to continue to pay their employees. They’re also reliant on a steady stream of income to meet their mortgage repayments.

These scenarios, and others like them, are sadly familiar to many business owners.

They highlight the need to access a steady income to meet personal and business expenses.

Yet, with 19%3 of small businesses admitting to having no insurance at all, many small businesses are still clearly grappling with the basics of business insurance.

What some small business owners may not understand is that there are options available for worst case scenarios when a business is forced to close operations for an extended period.

Business interruption insurance operates to cover business cash flow and in the process also protects the owner’s income stream and their investment in the business.

The cover pays for ongoing costs that continue regardless of whether the business is closed or substantially affected. These costs include rent, mortgage repayments, fixed electricity, gas and water charges. It also covers additional costs incurred to minimise the effects of the closure or downturn, plus net profit and/or loss.

What types of risk can cause an interruption to business?

Causes of interruption to businesses are constantly evolving.

Climate change, for example, is having an impact on the frequency and severity of storms, floods and bushfires.

And new risks can develop through advances to technology and social or political changes, including terrorism, regulatory changes, pollution and other environmental impacts or food supply.

But the risks faced by a business will vary based on the organisation, its critical operations, the risk management options available and a business owner’s risk appetite.

Thirty-six per cent4 of small businesses see losing clients as the biggest risk to their cashflow, compared to just 6% who identify a power cut, fire or weather event as the biggest threat to their cashflow.

As the research shows, business owners can often overlook indirect risks to their business. These could include events affecting property other than the insured’s own. For example, damage to the premises of customers or suppliers, providers of public utilities, access issues due to damage to adjacent premises, or to roads, bridges or railways.

Almost every type of business could be affected due to the potential ripple effect of damage an event such as public utilities breaking down could cause.

Retailers in a shopping centre cannot easily move to other premises and retain the same customer traffic. They also may have a high level of dependency to specific product suppliers.

Manufacturers have high dependency levels on customers and component parts suppliers. Wholesalers also face similar issues and may be severely affected by transport delays due to damage to roads or bridges.

Where services cover a wide geographic area, major delays can be experienced in relation to restoration, especially where catastrophe-scale storm or bushfire events happen.

How the policy works

A business interruption insurance policy is designed to ensure an organisation is in a comparable financial position despite exposure to an insurable event. To do this, insurers create a picture of the business finances as if no loss has occurred and then find ways to mitigate the impact of the loss so the business can continue to trade normally.

Policies may cover the cost of business consultants and specialists. Their advice may help reduce the impact of the recovery period with a view to avoiding a reduction in the organisation’s turnover.

At the end of the recovery period, the policy may cover the lost profit that is usually calculated based on the difference between the actual post loss business turnover, and what was financially modelled for the on-going business.

Some of the benefits of business interruption cover

- Personal income may be maintained so the business owners may meet their personal financial commitments i.e debts, payroll and lifestyle expenses

- Personal income may be maintained so employees can meet their personal financial commitments

- Ability to pay ongoing business expenses to help prevent the business from being wound up

- Help protect the capital invested in the business venture.

The research – Business interruption insurance and small businesses

Business interruption insurance is an often-misunderstood cover. Many small and medium businesses overlook it, think they won’t need it or assume they have it as part of a business insurance package when they don’t.

QBE Insurance commissioned research5 to investigate small business attitudes to business interruption to better understand base levels of knowledge, purchasing drivers and attitudes to risk mitigation.

What are the risks?

Losing clients is more alarming than a power cut, fire or weather event

Thirty-six per cent of small businesses see losing clients as the biggest risk to their cashflow, while 24% cite clients not paying invoices on time and rising costs (20%) as the most significant. 6% are concerned with a major client going bankrupt. The same percentage identify a power cut, fire or weather event as the biggest threat to their cashflow.

19% of small businesses have no insurance at all

Almost two-thirds (63%) believe their business has all the insurance they need, 14% say they’re underinsured and 3% think they’re over insured. The remaining one in five (19%) of small businesses say their business has no insurance at all.

17% of small businesses have business interruption insurance

49% of small businesses have some form of small business insurance and 39% have property insurance. Just one in six (17%) have business interruption insurance and 7% have cyber insurance.

What drives the decision to purchase business interruption insurance?

Peace of mind is the most powerful motivator

55% of small businesses who purchased business interruption insurance did so for peace of mind, while 47% said they bought it because they were worried they couldn’t stay in business if a fire, power failure or extreme weather event affected their premises. 26% said they purchased business interruption insurance because their broker advised them to buy it.

Small business owners don’t buy the product if they don’t understand it

Small business owners without business interruption insurance say the main reasons they chose not to buy the cover was because they don’t know anything about it (46%), it’s not relevant to their business (30%) and because it would be an unnecessary expense (29%).

43% of small businesses have never heard of business interruption insurance

One in five (19%) small businesses say they’ve looked into business interruption insurance and understand exactly what it covers. 23% say they have a vague idea that it covers business when operations are interrupted and 11% say they know it exists but don’t know anything about it. Four in ten (43%) small business owners say they have never heard of business interruption insurance.

What’s it worth?

More than a third (38%) of small business owners just paid the quoted premium when their business interruption insurance came due for renewal, while 34% reviewed their needs and adjusted the level of cover accordingly. 24% spoke to their broker before renewing their policy.

Conclusion

Business interruption insurance has clear benefits to small business owners who are looking to trade through the uncertainty of conducting business in a changing world.

But with just 17%6 of small businesses currently holding business interruption insurance, insurers and their partners clearly have work to do in amplifying the benefits of the cover and articulating how it answers their business continuity needs.

1 Based on analysis of QBE Insurance business interruption claims data from 2012-2016

2 Galaxy Research conducted an online poll of a representative sample of 501 Australian small business owners during September 2017

3 Galaxy Research conducted an online poll of a representative sample of 501 Australian small business owners during September 2017

4 Galaxy Research conducted an online poll of a representative sample of 501 Australian small business owners during September 2017

5 Galaxy Research conducted an online poll of a representative sample of 501 Australian small business owners during September 2017

6 Galaxy Research conducted an online poll of a representative sample of 501 Australian small business owners during September 2017